Enhancing Audit Quality: Insights from Singapore ACRA’s Audit Practice Guidance No. 1 of 2024

- Posted by admin

- On January 28, 2025

- 0 Comments

- Audit preparation, Financial audit guidelines, Internal controls review, Singapore audit process

In the ever-evolving business environment, maintaining high audit quality is essential for fostering trust and ensuring transparency in financial reporting. To address recurring audit deficiencies and enhance overall audit quality, the Singapore Accounting and Corporate Regulatory Authority (ACRA) has introduced Audit Practice Guidance No. 1 of 2024, focusing on Root Cause Analysis (RCA) and Remediation Plans (RAP). This structured approach aims to help Public Accountants (PAs) and Accounting Entities (AEs) identify systemic issues, implement targeted corrective actions, and foster sustainable improvements in audit processes.

The Imperative for RCA and RAP

Root Cause Analysis (RCA) is a structured methodology for diagnosing the underlying causes of deficiencies in audit engagements or quality control systems. By pinpointing the root causes, AEs can design effective remediation strategies that go beyond addressing superficial symptoms, ensuring that similar issues are mitigated in future audits.

Key triggers for RCA include :

- Partially Satisfactory or Not Satisfactory Outcomes from ACRA’s Practice Monitoring Programme (PMP).

- Quality Control (QC) deficiencies identified during reviews of an AE’s system of quality management (SoQM).

PAs and AEs must submit their RCA and RAP to ACRA within one month of receiving the Practice Monitoring Programme (PMP) outcome notification. The RCA and RAP process must be implemented within 12 months from the notification of the PAOC order. However, for critical areas that require early intervention, ACRA expects PAs and AEs to prioritize and plan remedial actions to address these issues at the earliest possible opportunity. This tight timeline underscores the importance of preemptive planning and efficient execution.

Planning for Effective RCA and RAP

To execute a robust RCA and develop a relevant RAP, PAs and AEs should :

- Establish a Detailed Plan and Timeline: Develop a comprehensive roadmap to ensure timely submission and thorough analysis.

- Engage Qualified Personnel: For smaller entities lacking internal resources, leverage experienced and objective RCA reviewers from central quality functions or engage third-party experts.

- Prioritize Critical Areas: Focus on deficiencies requiring immediate intervention to prevent further systemic risks. These critical areas could include significant errors in financial statements, repeated instances of non-compliance with auditing standards, or systemic issues in the quality management system.

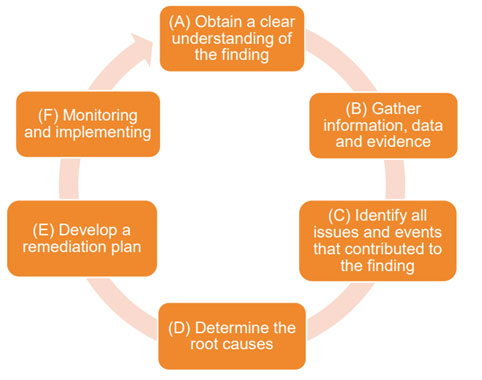

RCA Process: Breaking Down the Framework

1. Understand the Findings

The RCA begins by thoroughly understanding the identified deficiencies. This involves analyzing gaps in audit procedures and assessing deficiencies in the AE’s SoQM.

2. Gather Information and Evidence

Public Accountants (PAs): The focus is on deficiencies in specific audit engagements. Information gathering involves a detailed review of the engagement working papers, consultations, and interviews with the audit team, including specialists, to understand the immediate causes of findings.

Accounting Entities (AEs): The emphasis is on deficiencies in the quality management (SoQM) system. Information gathering includes evaluating the design, implementation, and operation of related SoQM processes. Process owners and control operators are interviewed to assess their roles, responsibilities, and the operational environment, ensuring alignment with quality objectives.

3. Identify Contributing Factors

Contributing factors, or causal factors, provide insight into the events and conditions that led to the findings. These may include human errors, procedural gaps, or organizational shortcomings.

4. Determine Root Causes

Techniques like the 5 Whys and Fishbone Diagrams are instrumental in uncovering the foundational root causes. These methods encourage deep questioning and systematic categorization of potential issues.

5. Develop a Remediation Plan (RAP)

The RAP should be tailored to address each root cause comprehensively. ACRA recommends adhering to the SMART framework:

- Specific: Clearly define actions, responsibilities, and resources.

- Measurable: Set quantifiable progress metrics.

- Attainable: Ensure feasibility within resource constraints.

- Relevant: Align actions with root causes.

- Time-bound: Set realistic timelines with milestones for accountability.

6. Monitor and Implement

The final step involves rigorous implementation and monitoring to ensure the RAP’s effectiveness. This includes ongoing progress tracking, interim testing, and performance evaluations to address any gaps during execution.

Avoiding Common Pitfalls

ACRA’s guidance highlights frequent missteps in the RCA and RAP process:

- Stopping at surface-level causes without delving deeper.

- Confusing symptoms with root causes.

- Assigning blame instead of addressing systemic issues.

- Underestimating the importance of comprehensive data collection.

- Rushing the process at the expense of robust analysis.

AEs can ensure that their remediation efforts deliver meaningful and lasting improvements by avoiding these pitfalls.

KNAV’s Comments

Improvement begins with recognizing and addressing errors. Whether in life or the audit process, growth stems from acknowledging mistakes and taking corrective action. Effective RCA and RAP processes transcend mere compliance tools; they serve as transformative strategies to elevate audit quality. By shifting the focus from reactive solutions to proactive, systemic enhancements, these practices empower AEs and PAs to embrace continuous improvement and foster a culture of quality consciousness, driving meaningful change in the audit landscape.

As audit processes grow increasingly complex, Singapore ACRA’s guidance offers a comprehensive framework for identifying and rectifying deficiencies for audit professionals and audit firms across jurisdictions. This structured approach reinforces trust in financial reporting and upholds the integrity of the business environment.

0 Comments