Adopting Intangibles Disclosure Framework

- Posted by kalyani

- On January 30, 2024

- 0 Comments

Introduction

In 2023, the Intellectual Property Office of Singapore (IPOS) and the Accounting and Corporate Regulatory Authority (ACRA) have introduced the Intangibles Disclosure Framework (the “IDF”) that is among the first of its kind globally. This new framework, aligned with the Singapore Intellectual Property Strategy 2030 (the “SIPS 2030”), aims to enhance the disclosure and communication of the value of the intangible assets (the “IA”).

In 2021, Singapore introduced the SIPS 2030, a national initiative aimed at bolstering Singapore’s global standing as an Intangible Assets and Intellectual Property hub. Intangible assets generally refer to non-physical assets, encompassing both registrable intellectual property such as brand names, trademarks, patents, and designs, and non-registrable IA such as copyright, trade secrets, know-how, or software codes. It grants rights and/or economic benefits to its owner.

With a focus on fostering a vibrant and innovative future economy, the SIPS 2030 seeks to capitalize on opportunities in intangible assets. One of its long-term objectives is to establish a credible intangible asset valuation and reporting ecosystem, supporting enterprises in effectively managing and commercializing their intangible assets. This endeavor contributes to overall business strategy and value.

Globally, the valuation and reporting of intangible assets are in early stages of development, with no jurisdiction having established a specific disclosure or valuation framework for the IA. Taking initial steps, the SIPS 2030 has developed the IDF, outlining key principles for enterprises to identify and communicate details about their intangibles.

Providing consistent information based on the IDF’s principles enables stakeholders to make more informed assessments of business and financial prospects, facilitating the commercialization of intangibles. Additionally, harmonized disclosures assist investors and lenders in making comparisons across enterprises, thereby enhancing the flow of funds into businesses that strategically invest in intangibles.

Key Principles of the IDF

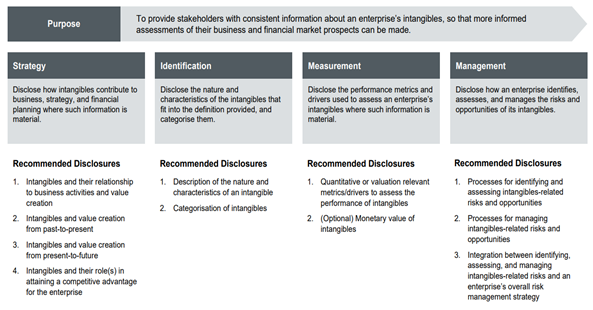

The IDF’s key principles revolve around four pillars: Strategy, Identification, Measurement, and Management (SIMM), as shown in the table below. Addressing all four pillars is crucial, with the order of their consideration being secondary.

The Strategy Pillar

This pillar facilitates the disclosure and communication of how intangibles contribute to an enterprise’s overall corporate strategy. Its objective is to offer stakeholders a deeper understanding of how an enterprise utilizes its intangibles to generate returns for investors. It also sheds light on the role that intangibles play in various business aspects, potentially providing a competitive advantage in the market.

The Identification Pillar

Encompassing the definition of the IA, this pillar recommends how enterprises should describe the nature and characteristics of their intangibles. It proposes classifying intangibles into six categories, which includes marketing-related, customer-related, contract-related and others, to enhance comparability. By providing clear definitions for each category, this pillar aims to facilitate improved comparability among different intangibles.

The Measurement Pillar

This pillar guides enterprises in disclosing performance metrics and drivers of their intangibles. The information disclosed enables both the enterprise and stakeholders to better assess and understand the financial health and performance of an enterprise’s intangibles. Ideally quantitative and value-related information, such as metrics and value drivers, should be disclosed. While encouraged, revealing the monetary value of intangibles is optional under this pillar.

The Management Pillar

Providing guidance on disclosing the identification, assessment, and management of risks and opportunities related to intangibles, this pillar recommends enterprises disclose how these processes are integrated into overall group risk management practices. It ensures transparency in how an enterprise handles risks and opportunities associated with its intangibles.

Illustration 1: Table – The IDF and SIMM Pillars

Source: The Intangibles Disclosure Framework 2023

Primary Benefits of Adopting the IDF

It is evident that, in an era of digitalization, the future of value creation will be increasingly steered by intangibles. The adoption of a robust disclosure and valuation framework is beneficial for several reasons:

Significance of Intangibles in the Digital Economy

- With the global economy pivoting towards innovation, intangibles are emerging as significant value contributors. Such assets constitute significant value in the assets of S&P 500 companies.

- Recognized assets like brand names and patents continue to play a pivotal role, while emerging technologies, such as blockchain and digital assets, are reshaping business models.

- Investments in intangible assets have surpassed those in tangible assets for over two decades, reflecting their increasing importance.

Usage and Value of Intangibles

- Global payments for intellectual property usage have surged by 74% in the last decade, exceeding $515.26 billion.

- Intangibles’ estimated value reached a record of $74 trillion in 2021, constituting 54% of global value.

- This trend highlights the need for a framework facilitating consistent identification, categorization, and disclosure of intangibles.

Harmonization and Comparability through Disclosure

- To ensure comparability, disclosures should be consistent and reference intangibles on a like-for-like basis.

- The IDF is crucial as no jurisdiction has developed a common language for intangibles, often resulting in underappreciation in the financial reporting.

- By establishing key disclosure principles, the IDF lays the groundwork for harmonization within similar sectors, paving the way for new valuation methods.

Growth Flywheel of Value Creation

- Treating intangibles as a distinct asset class opens avenues for new commercialization options.

- Start-ups with strong intangible portfolios can attract capital based on their intangibles, providing new financing possibilities.

- Listed enterprises can quantify and differentiate the value contributed by intangibles, presenting opportunities for growth.

- The IDF empowers enterprises to understand, measure, and disclose the contribution of intangibles, unlocking their full potential for value creation.

Potential Challenges in Adopting the IDF

While the adoption of the IDF brings forth numerous benefits, enterprises may encounter certain challenges in its implementation:

Complexity of Intangibles

Intangibles, by their nature, can be complex and diverse. Classifying and describing them may pose challenges, especially when dealing with rapidly evolving technologies and innovations.

Subjectivity in Measurement

Quantifying the value of intangibles can be subjective. Determining performance metrics and drivers may involve judgment calls, leading to potential variations in disclosure practices.

Resource Intensiveness

Implementing the IDF may demand additional resources, both in terms of time and financial investment. This could be a concern for smaller enterprises with limited capacity for comprehensive disclosure.

Integration with Existing Practices

Aligning the IDF with existing reporting practices and accounting standards may require adjustments. Integrating the new framework seamlessly into established processes could pose a challenge. However, the IDF does not replace or supersede existing regulatory or accounting requirements.

Resistance to Change

Organizations may face resistance to change from stakeholders accustomed to traditional reporting methods. Educating and garnering support for the IDF might be necessary.

Disclosure Sensitivity

Some enterprises may be hesitant to disclose certain information related to their intangibles, considering it sensitive or proprietary. Balancing transparency with confidentiality could be a delicate task.

Global Consistency

Achieving global consistency in the application of the IDF might be challenging due to varying regulatory landscapes and cultural differences across jurisdictions.

Continuous Evolution of Technologies

As technologies evolve rapidly, the IDF may need frequent updates to remain relevant. Staying abreast of technological advancements and updating the IDF accordingly is an ongoing challenge.

Navigating these challenges will be crucial for enterprises aiming to leverage the benefits of the IDF and enhance their intangibles disclosure practices.

Implementing the IDF

The adoption of the IDF is voluntary at this juncture, acknowledging the novelty of an intangibles-specific disclosure framework. The goal is to gradually mainstream intangibles disclosure in corporate reporting, aiming for eventual harmonization with broader reporting practices. The IDF is expected to facilitate effective intangibles management and commercialization, offering several benefits:

Understanding and Communication

A consistent IDF allows businesses to understand, evaluate, and communicate intangibles more effectively, supporting outcomes such as business expansion, marketing, and capital raising.

Internal Strategy Enhancement

Recognition of an enterprise’s intangibles enables senior management to build a comprehensive corporate and business strategy around these assets.

Market Transparency

Consistent disclosure enhances market transparency, increasing confidence in commercial transactions involving intangibles.

Conclusion

Bringing intangibles disclosure into mainstream reporting for widespread understanding represents a comprehensive, multi-year undertaking. Realizing the advantages of improved intangibles disclosure necessitates collaborative endeavors from both the public and private sectors. The initiation of the IDF marks a crucial first step in establishing a solid groundwork, steering Singapore towards constructing a reliable and trusted ecosystem for valuing and reporting intangible assets. The implementation strategies and recommendations provided lay the groundwork for the enduring adoption of intangibles disclosure, fostering transparency and strategic management of intangible assets.

0 Comments