Leveraging FinTech for Business Growth and Compliance in Singapore

- Posted by kalyani

- On February 7, 2024

- 0 Comments

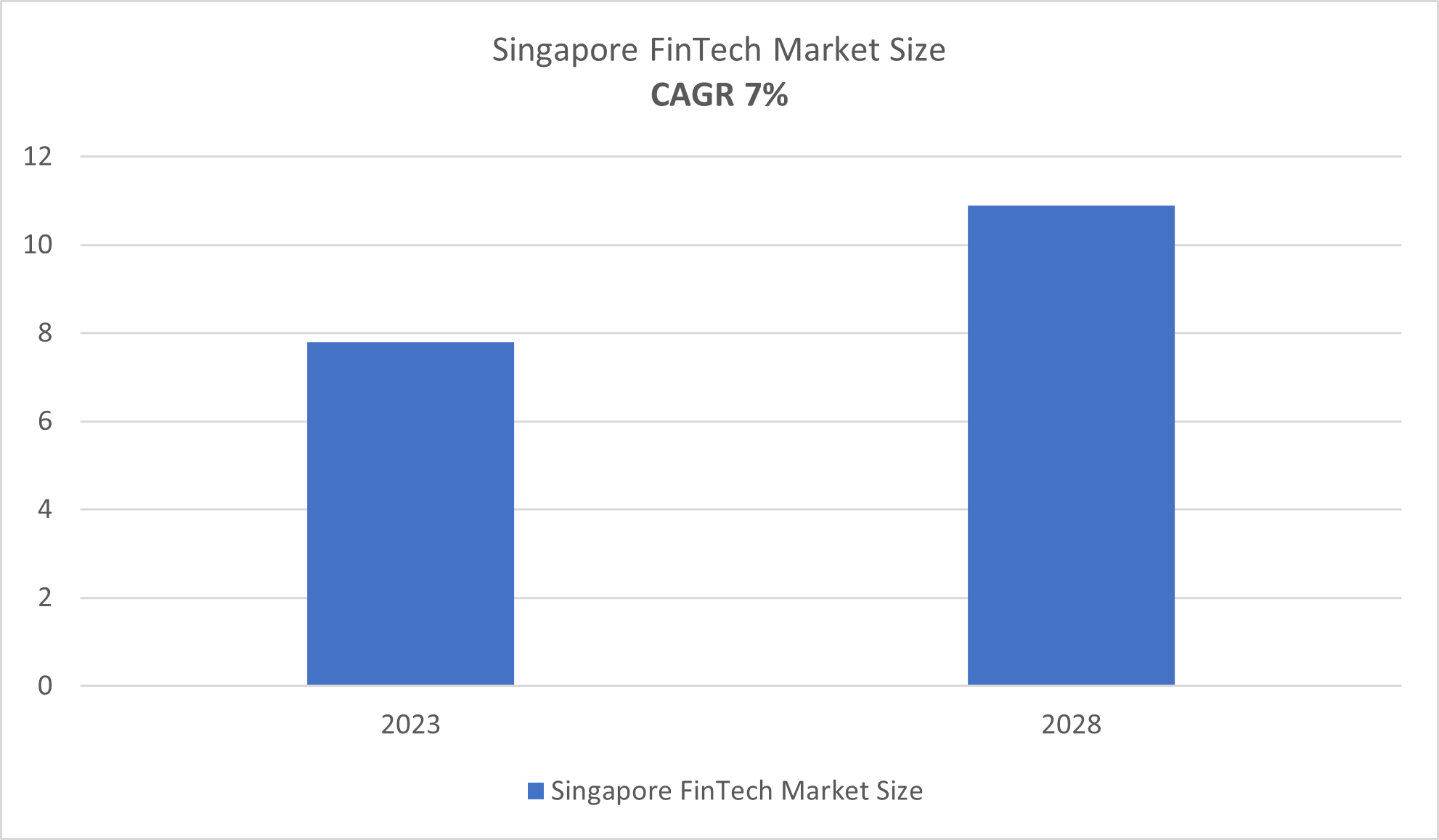

The Singapore fintech market is expected to grow by 7% annually, in the next 5 years. It is currently valued at USD 7.8 billion. A new generation of FinTech entrepreneurs is exploring white spaces in wealth management, capital markets, insurtech, regtech, and data analytics. As a result, FinTech has developed into a thriving industry in Singapore.

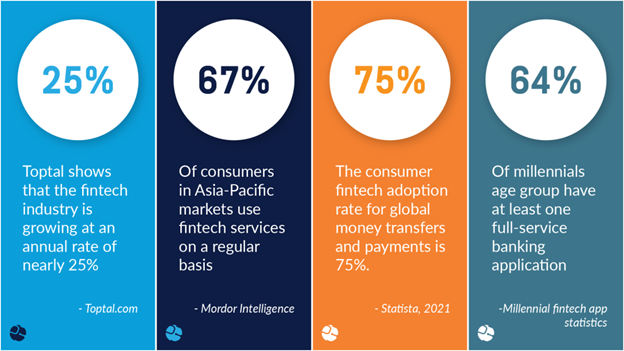

Global Fintech Adaption Scenario

Source: https://brainstation-23.com/why-businesses-are-turning-to-the-fintech-revolution-for-businesses-growth/

In Singapore, the fintech market has been driven significantly by blockchain technology. Payment solutions that are secure and efficient can be developed with blockchain technology. The result has been the growth of blockchain-based payment startups providing cross-border payment services at low costs and with high levels of security. The use of blockchain technology can help companies comply with regulations more efficiently. Businesses can demonstrate compliance with regulatory requirements more easily with blockchain-based solutions that create secure and tamper-proof records of transactions.

The fact that Singapore has direct access to many customers in Southeast Asia as well as many partners who have regional headquarters there makes it well-suited as a regional hub for FinTech. Southeast Asia is an excellent conduit between companies and these neighbouring countries due to its economic powerhouse status. Besides the obvious physical proximity, the country has an extensive network of some 27 implemented free trade agreements. In addition to its conducive business environment, it has a strong technological and financial infrastructure that balances risks associated with investing in emerging economies.

Singapore Fin Tech Market

Source: Mordor Intelligence

Leveraging Financial Technology (FinTech) for business growth and compliance in Singapore has become increasingly vital as the country positions itself as a global FinTech hub. Singapore’s progressive regulatory environment, robust financial infrastructure, and strong commitment to innovation create an ideal ecosystem for businesses to harness FinTech solutions. Here’s a detailed exploration of how companies can leverage FinTech for both business growth and compliance in Singapore:

Digital Payments and Transactions:

Singapore boasts a highly developed digital payment ecosystem. Businesses can leverage this by adopting digital payment platforms and mobile wallets. This not only streamlines payment processes but also reduces transaction costs, enhances cash flow management, and offers customers convenient payment options. Moreover, real-time payment solutions can be implemented to improve transaction efficiency, reducing the need for time-consuming manual processing.

Regulatory Technology (RegTech):

Compliance with financial regulations is paramount in Singapore. FinTech companies offer RegTech artificial intelligence (AI) solutions that automate and simplify compliance tasks. These tools can help businesses monitor and report compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, reducing the risk of regulatory breaches. The integration of data analytics and AI-driven compliance tools enables the early detection and prevention of financial fraud, ensuring ongoing regulatory adherence. Throughout the years, AI has become increasingly sophisticated, allowing it to be used for fraud detection, identity verification, money laundering and terrorist financing. Using blockchain technology, transactions are nearly impossible to alter once they are confirmed, providing a high level of security. AI goes further by detecting and preventing potential security breaches. A deep learning algorithm identifies anomalous activity as adversaries scan network assets for vulnerabilities. With AI, predictions about the future can be made using data from blockchain transactions and market movements.

Robotic process automation (RPA) is one such technology which is useful to large financial institutions to automate their massive-scale regulatory related remediation programs. It also aids in maintaining business compliance. Another technology, Natural language processing (NLP) is a kind of AI which reads the text and the plugs in to the regulatory requirements. There are other areas where financial institutions are implementing AI tools such as transaction monitoring and trade surveillance.

Blockchain and Distributed Ledger Technology (DLT):

Singapore has recognized the potential of blockchain and Distributed Ledger Technology (DLT) in various industries. Businesses can explore applications of these technologies for transparent and secure record-keeping, particularly in trade finance and supply chain management. Smart contracts, powered by blockchain, can automate and self-execute compliance-related agreements, minimizing disputes and improving trust in transactions.

Crowdfunding and Peer-to-Peer Lending:

For companies seeking alternative financing options, Singapore offers regulated crowdfunding and peer-to-peer lending platforms. These platforms provide access to diverse sources of funding, supporting business expansion plans. It’s crucial to ensure that fundraising activities comply with Singapore’s regulatory requirements, promoting transparency and investor protection.

Robo-Advisors and WealthTech:

Wealth management and investment advisory services can be streamlined and made more cost-effective through robo-advisors and WealthTech solutions for better client relationship. These technologies use algorithms to manage investment portfolios efficiently. However, businesses must ensure that they comply with financial advisory regulations when providing automated investment advice to clients. With advanced algorithms such as ChatGPT, end-users can get real-time information and suggestions based on massive data sets.

Singapore offers grants for AI research through partnerships with other countries, determined at the national level. These calls aim to foster collaboration between Singapore and overseas research communities, resulting in significant advances in AI. 100 Experiments (100E) provides co-investment support to companies looking to deploy artificial intelligence.

Sustainability:

A growing number of stakeholders are inadvertently pressuring businesses to adopt greener practices in 2030, which presents an opportunity for sustainability technology companies to offer their solutions. A green economy is accelerated by FinTech, which unlocks green opportunities. To foster a green finance ecosystem, the Monetary Authority of Singapore launched Project Greenprint in 2020. Green Finance Industry Taskforce published a detailed guide for financial institutions to use when determining whether a transaction is eligible for green trade financing. Through the Greenprint ESG Registry, financial institutions, corporations, and regulatory authorities can access these data via a blockchain-based data platform that provides a tamper-proof record of sustainability certifications and verified sustainability data. ESGenome provides companies and investors with a digital disclosure portal for reporting ESG data in a consistent and comparable manner.

Cybersecurity Solutions:

Protecting sensitive financial data is a top priority in Singapore. Businesses can leverage advanced cybersecurity technologies and services to safeguard their operations and customer information. Regular cybersecurity audits and updates are essential to address emerging threats while ensuring compliance with data protection regulations.

Open Banking and API Integration:

Open banking initiatives and Application Programming Interfaces (APIs) enable secure data sharing and collaboration with financial institutions and partners. This fosters innovation and the development of customer-centric financial services. However, data privacy and security should always be maintained while adhering to open banking standards and relevant regulations.

Regulatory Reporting Automation:

Compliance with regulatory reporting requirements is crucial for businesses in Singapore. FinTech solutions can automate these reporting processes, ensuring accuracy and timeliness in compliance submissions. Staying informed about changes in regulatory reporting requirements and adapting systems accordingly is essential to avoid penalties and reputational risks.

Data Analytics and Business Intelligence:

Data analytics and business intelligence tools can provide valuable insights into financial performance and customer behavior. By adopting data-driven strategies, businesses can identify growth opportunities, optimize operations, and enhance the customer experience, all while staying compliant with relevant regulations.

Conclusion

In conclusion, Singapore’s thriving FinTech ecosystem offers numerous opportunities for businesses to achieve both growth and compliance objectives. By embracing FinTech solutions, companies can navigate the evolving regulatory landscape effectively while capitalizing on the benefits of technological innovation. It is imperative, however, to stay abreast of regulatory updates and ensure that FinTech solutions align with Singapore’s financial regulations and compliance standards to reap the full rewards of this dynamic environment.

0 Comments