Valuation of Early-stage Companies/Start-ups

- Posted by kalyani

- On February 26, 2024

- 0 Comments

The term start-up refers to a company in the first stage of operations, founded by one or more entrepreneurs who have or are in the process of developing a unique product or service for which they believe there is demand. A start-up aims to remedy deficiencies of existing products or create entirely new categories of goods and services, disrupting entrenched ways of thinking and doing business for entire industries. That’s why many start-ups are known within their respective industries as “disruptors.” Navigating the complex journey from idea conception to plan execution, startups stand as a testament to the innovative minds shaping our society.

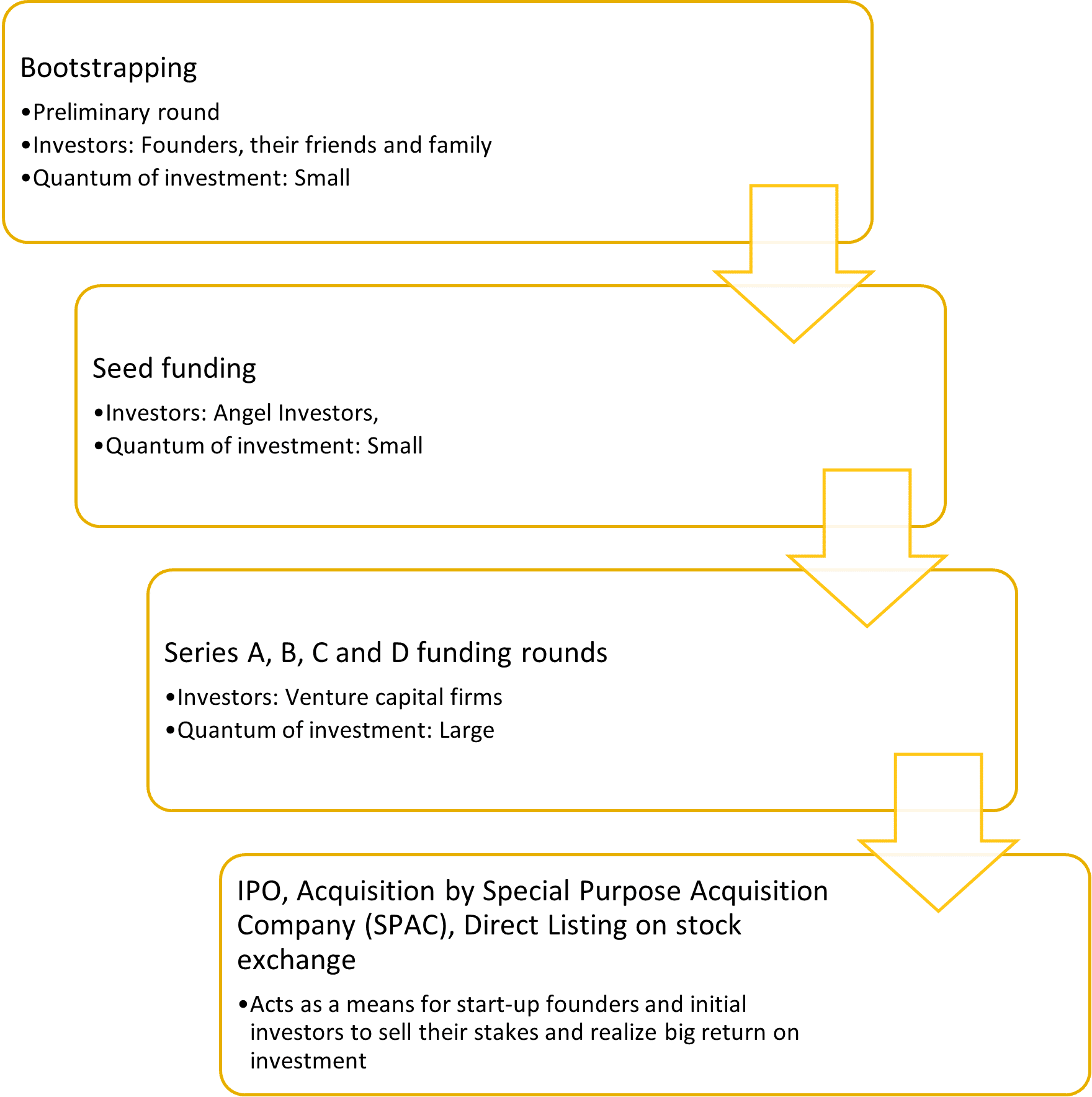

However, the innovation drives a hard bargain. These companies generally start with high costs and limited revenue, and often require large investments to grow their enterprise and invest in research and development. Amidst this journey, securing funding becomes a crucial component. The funding cycle of start-ups is illustrated below:

Understanding Startup Valuation

Each round of funding and issued security, as described in the above section typically necessitates some form of professional valuation. Startup valuation, while a subset of business valuation, is a more comprehensive and detailed, considering a myriad of influencing factors and comparative analyses. These factors span the spectrum of past and current performance, market traction, strategic partnerships, and the envisioned roadmap for the future. Importantly, startup valuations are dynamic, evolving with the startup’s performance, growth trajectory, and subsequent fundraising activities. Various elements, including the duration of the startup’s existence, stability of earnings, and industry-specific nuances, contribute to the intricate process. This article delves into the fundamentals of startup valuation, unraveling the key aspects that underpin this critical evaluation.

Startups vs. Mature Businesses

Mature businesses, or companies with stable cashflows, are often armed with established customer bases, market share, operational efficiency and boast a solid operational foundation for valuation. With clearly defined revenue streams and assets, the valuation process for a seasoned business becomes more straightforward.

However, the dynamics shift significantly when it comes to valuing a startup. Unlike their mature counterparts, startups lack stable revenue streams, operational histories, and established benchmarks, amplifying the risk factor inherent in their valuation.

Consequently, startup valuation demands a specialized approach, accommodating the high-risk nature inherent in these ventures. While business owners may harbor expectations of elevated valuations, investors often favor a more pragmatic approach, aligning with realistic projections that ensure a favorable return on investment.

The fluidity of startup valuation further sets it apart, with various techniques and methods employed by investors yielding diverse outcomes. Subject to frequent changes, the dynamic nature of startup valuations underscores the importance of a meticulous and adaptive approach. As the start-up matures, the method of valuation may also change significantly, shifting from a focus on qualitative inputs to quantifiable ones.

Seed stage startups typically exhibit minimal revenue and traction. Valuing a seed stage startup becomes particularly challenging before achieving product-market fit. Establishing clear milestones within specific timeframes and determining required resources aids in the valuation process. Additionally, comprehending market demand and competitiveness is crucial for negotiating terms with angel investors and venture capitalists.

Valuating start-ups that have achieved series funding involves considering various factors, including the startup’s performance, assets, revenue forecasts, and other applicable methods tailored to this stage.

Valuation methods for startups

As previously mentioned, startup valuation plays a pivotal role in future planning and is of utmost importance. Given that startups, at the valuation stage, often lack substantial revenue, determining their value requires meticulous analysis of diverse internal and external factors. In the following, we will explore seven widely used methods for valuing startups.

The Berkus Method

Developed by angel investor Dave Berkus, this method centers on envisioning a startup reaching $20 million within five years. The Berkus method applies a scale of five components in a start-up, rating each from zero to $0.5 million ($0.4 million in case of a pre-revenue start-up), i.e., the maximum value earned in each category. Thus, the maximum value a start-up can achieve under this valuation is $2.5 million.

It focuses on the five qualitative parameters to arrive at a value:

- Concept: The idea must blend creativity and innovation, offering fundamental value with an acceptable risk ratio, and represents the appeal of the business to the buyer

- Prototype: A prototype is a n original model on which something is patterned. A fully functional prototype sets the stage for a smoother launch and reduces the risk of initial failure.

- Quality of Management: The experience and the ability of the management ensures effective leadership for better planning and risk mitigation.

- Strategic relationships: Intelligent networking enhances the chances of success, fostering

- Product Rollout/Sales A well-structured launch plan increases the likelihood of achieving business goals. The effectiveness of the startup’s sales and marketing strategy, including customer acquisition plans, may be taken into account.

The Berkus method of valuation is a starting point for negotiation, considering the degree of subjectivity involved in estimation of the amounts to be assigned for each factor. The experience and background of the investor using the Berkus Method can influence the weight assigned to each factor.

Scorecard Valuation Method

Developed by angel investor and entrepreneur Bill Payne, the Scorecard Method involves assigning scores and weights to specific criteria, providing a structured way to evaluate a startup’s potential. The scorecard valuation method looks at different aspects of a business, like its management team, marketing/sales partnerships, target market and customers, size and scalability, etc., and is often considered more comprehensive than the Berkus method.

Each criterion is assigned a numerical score, typically on a scale of 1 to 5, with 5 being the highest. Different criteria may be given different weights based on their perceived importance. For example, a strong management team might be assigned a higher weight than a specific stage of business development. Thereon, a score is obtained, which is then benchmarked against a standard valuation, often based on the average pre-money valuation of comparable startups in the same industry and stage.

The Scorecard Method is often used in conjunction with other valuation methods to provide a more comprehensive understanding of a startup’s value. It is particularly well-suited for angel investors and early-stage investments where financial metrics may be limited.

Risk Factor Summation Method

The risk factor summation method involves comparing a startup to others based on 12 risk factors, determining its risk profile’s impact on valuation. Lower risks typically result in a higher valuation, while higher risks may lower the startup’s overall worth. A positive, neutral, or negative score within the range of -2 to 2 indicates the seriousness of the risk, with -2 being an extremely negative and thus risky outlook, and on the opposite end of the spectrum, 2 being an extremely positive and thus healthy outlook. The sum of the values is then multiplied by a flat number (typically $250,000) and then this premium (or discount) is added to the original base value of the comparable company to arrive at the final value of the business.

This method helps in determination of a premium/discount that an investor would pay, rather than a base price/intrinsic valuation.

Venture capital method

This method focuses on estimating the potential returns for investors by projecting the future exit value of the startup. The method assumes that the primary way for investors to realize returns is through the sale of their equity stake in the startup, often through an acquisition or initial public offering (IPO). Investors typically set a projected time frame, often 5 to 7 years, during which they anticipate the startup to exit, i.e., be acquired or go public, and expect an ‘X’ amount of returns on their investment, which is typically an earnings multiple, like P/E, or EV/EBITDA.

The expected sale value is then discounted back to present day, using a risk adjusted factor. Investors specify their required rate of return, reflecting the risk associated with the investment. This rate is often higher for early-stage investments to compensate for the higher risk.

The method is inherently forward-looking, relying on projections and assumptions about the future, making it sensitive to changes in market conditions and industry dynamics.

Price of recent investment method (PORI)

The recent investment in the business is often taken as the base value if there have been no substantial changes since the last investment, and thus can provide a basis for valuation, but only for a limited period. The fair value indicated by a recent transaction in the portfolio company’s equity may be used to calibrate inputs used with various valuation methodologies, it there has been a sufficient time between the transaction date and the valuation date.

Common errors in start-up valuation:

The valuation of start-ups is a profoundly subjective process, as they need a track record of generating cash flows and previous rounds of valuations. It is rightly said that the valuation of startups is as much an art as a science. Evaluating and determining which or a combination of methods must be employed to value a start-up company properly is imperative.

- Value misconception: For most subject companies, valuation is often a linear assessment – the company accrues value through growth in earnings and achieving stability. However, the dynamic nature of start-ups requires constant assessment, as no valuation remains permanent during this phase. The business is exposed to significant uncertainty, and there are often no reliable data points or trends in their projected financial data that can be corroborated.

- Subjectivity: Projections for revenue and profitability are often speculative, and there’s a high degree of uncertainty regarding a startup’s ability to achieve its financial forecasts. Valuation often relies on assumptions about growth rates, market penetration, and competitive landscape, introducing a subjective element that can vary among investors, particularly the selection of an appropriate discount rate.

- Overemphasis on Numbers: Although numbers and statistics offer insights, fixating solely on them overlooks the nuanced nature of startup success. Some highly successful companies faced substantial risk in their early stages, emphasizing the potential for greater rewards. Evaluating a startup should extend beyond hard figures to consider factors like business credibility, offering a more comprehensive outlook.

Navigating these challenges requires a combination of financial modeling, industry knowledge, and a thorough understanding of the startup’s unique characteristics. Investors and founders often collaborate closely to arrive at a valuation that aligns with the startup’s growth potential and risk profile. An experienced appraiser can help newly formed ventures to navigate the complex world of funding, valuations and acquisitions, and helps develop investor confidence in the management.

0 Comments