Accounting estimates including fair value measurement are among the top and common inspection findings highlighted in ACRA Practice Monitoring Programme’s Report from 2019 to 2021. Such audit deficiencies include a lack of adequate assessment of the reasonableness of inputs, variables and assumptions used in the discounted cash flow method.

Accounting estimates including fair value measurement are among the top and common inspection findings highlighted in ACRA Practice Monitoring Programme’s Report from 2019 to 2021. Such audit deficiencies include a lack of adequate assessment of the reasonableness of inputs, variables and assumptions used in the discounted cash flow method.

Hence, an external valuation expert firm could be engaged by the audit firms to audit and document valuation assumptions and assertions impacting their clients’ financial statements.

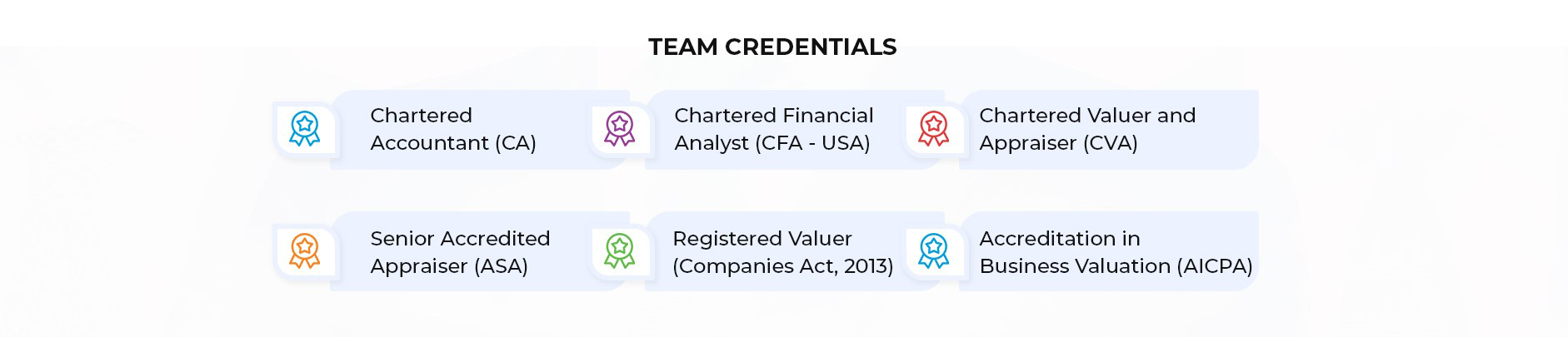

KNAV is one of the top choices for audit firms requiring valuation support to satisfy the requirements of professional standards and regulators.

KNAV VALUATION SUPPORT SERVICES GENERALLY INCLUDE REVIEW OF:

Impairment analysis for goodwill, intangibles and other financial assets

Purchase price allocation relating to business combination

Employee stock options valuation

Financial instruments valuation (including convertible bonds)

Inputs and Variables used in valuation method (such as discounted cash flow method)

Database and Valuation Resources

S&P Capital IQ

Bloomberg

Thomson Reuters Refinitiv

KtMine Royalty Database

Prowess

PrivateCircle

Dealstats

MergerStat Control Premium Study

Pitchbook

PLURIS DLOM Database

Awards And Recognition

“Best of Accounting Client Satisfaction” By ClearlyRated

“Fastest Growing Firms in the Top 400 firms sub-group”

by INSIDE Public Accounting”

“100 Fastest-Growing Asian American Businesses” by USPACC